Owners of detached homes in Port Coquitlam will see another $41 tacked on their property tax bill come July, should city council adopt the draft budget this spring.

This week, the city made public its proposed tax rates that, if approved, calls for:

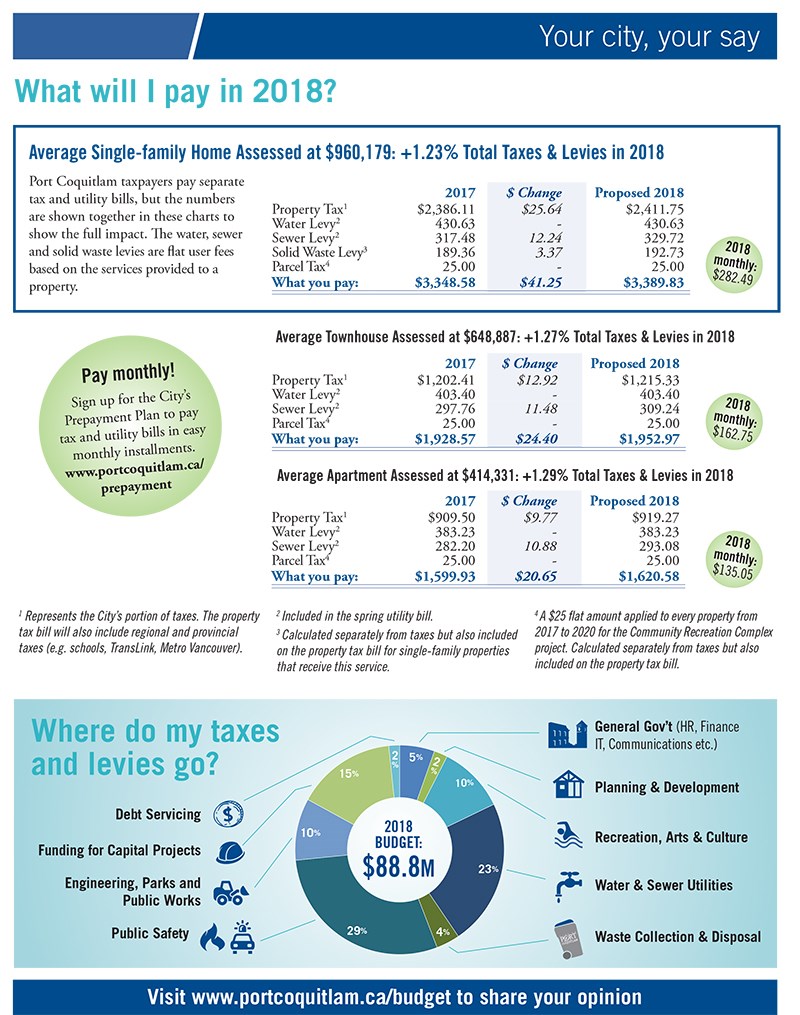

• a 1.23% boost — or an extra $41.25 — for an average single-family home assessed at $960,179;

• a 1.27% rise — or an additional $24.40 — for an average townhouse assessed at $648,887;

• and a 1.29% jump — or $20.65 more — for an average apartment assessed at $414,331.

The proposed rates include solid waste and sewer levy increases (water charges stay neutral this year) as well as the $25 parcel tax to pay for the recreation complex rebuild (that yearly parcel tax will be in effect until until 2020).

Under the proposed $88.8-million operating budget, city council plans to use the extra taxpayer funds to, among other things:

• hire two new firefighters for firehall #2 on the city’s northside to meet demand ($180,000);

• keep Terry Fox Library open longer on Sundays, except for long weekends ($19,400);

• move fire calls to E-Comm ($140,000);

• host the third annual PoCo Grand Prix cycling race ($77,000);

• and ready for the Oct. 20 civic and school board elections ($100,000).

If the budget goes ahead, the city will have recruited 20 more firefighters over the past six years, said Coun. Dean Washington, chair of the city’s finance and budget committee.

Washington told The Tri-City News that PoCo council won’t be hiring more Mounties this year as the RCMP detachment it shares with Coquitlam didn’t ask for more officers. “The crime rates are down,” he suggested.

Washington also said PoCo will also likely have the lowest property tax lifts in Metro Vancouver (in December, Coquitlam passed a 2.41% hike while Port Moody has yet to debate its draft budget).

By comparison PoCo homeowners paid 4.23% — or $113.91 — more in property, parcel and utility taxes last year.

Washington said city council was able to keep tax increases low this year by shaving costs in each department. “There were no cuts in labour,” Washington stressed, “and it won’t affect service levels at all.”

He added council won’t be contributing as much as in past years to its reserves, which also translates to savings to taxpayers. “I’m excited in the direction that the city is going in financially by being able to keep tax increases low while still building a massive recreation centre in our downtown,” Washington said.

For businesses, the draft budget translates to 1.73% increase for large industrial sites, 1.12% for large-format retail, 1.06% for medium-sized retail and 1.29% for small retail, according to a city release.

The tax rate hikes come as residential assessment values rose by 33.86% on average last year.

Farouk Zaba, PoCo’s manager of financial planning and systems, told The Tri-City News, the municipality uses assessments to figure out how much property owners have to pay in civic taxes. “The proportion collected from each owner is calculated by the percentage of their assessment value compared to the total assessment value of all properties within the city, for that class,” he noted in an email.

Meanwhile, residents can have their say on the draft financial plan — before city council starts deliberations on March 27 — by taking a survey at portcoquitlam.ca/budget, calling 604-927-5280 or emailing budget@portcoquitlam.ca. The deadline for feedback is Feb. 12.

jcleugh@tricitynews.com