Metro Vancouver property owners are paying more than their fair share of property taxes and should either get a break or more money should be directed to local schools, affordable housing and transit, say the region’s mayors.

The recommendation comes as the provincial parties gear up for an election campaign that officially kicks off next week, and it wouldn’t be the first time provincial property taxes have been tinkered with.

This time, the targets are the homeowner grant (for property owners with homes assessed at less than $1.6 million); the school tax, which cities collect on behalf of the province to pay for schools; and the property transfer tax, which is paid by home buyers and which has injected $1.5 billion into provincial coffers.

Property tax reform has been implemented in dribs and drabs over the years since a major overhaul in the early 1980s but Port Coquitlam Mayor Greg Moore says high home assessments mean conditions are ripe to take another look at changes.

He wants to see the major provincial parties offer policy suggestions during the election campaign to make them more fair.

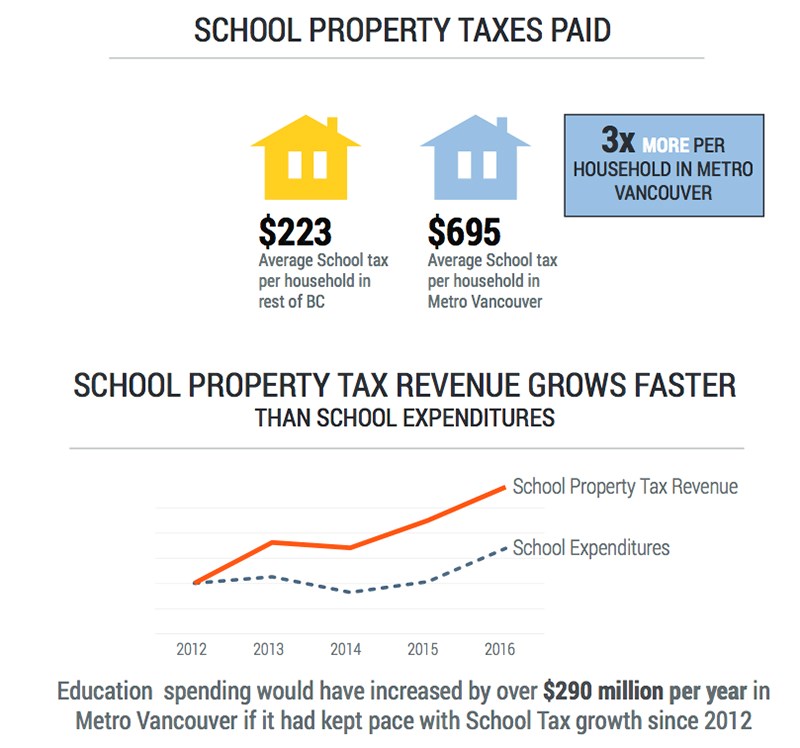

“We are paying about $1,000 more per resident home in Metro Vancouver for provincial property taxes than outside of the Metro Vancouver region,” Moore said.

But one academic suggest mayors are “barking up the wrong tree” with their proposals to give homeowners a break on property taxes.

Tom Davidoff, a UBC associate professor, says homeowners sitting on a mountain of equity in single-family homes, and people over 55 are deferring their taxes, preventing the kind of densification needed in Vancouver to make the city affordable.

The situation isn’t as dire in the suburbs, he said, but cutting income and sales taxes while maintaining property taxes would be a better way to go, Davidoff said.

“The idea that we need to ease the property tax burden on homeowners is not the kid of forward-looking policy leadership [he would like to see] come from a group like Metro Vancouver.”

Moore said the mayors aren’t encouraging drastic changes to how the government raises its revenue; rather they are seeking some tweaks to make property taxes collected for the province more equitable.

First, the Metro Vancouver mayors would like to see the threshold for homeowner grants in the region increased so that 91% of property owners would qualify, equal to the provincial average. Currently, only 82% get the tax break but if the threshold were increased to $2.2 million from $1.6 million, 67,000 more homes would be eligible, saving residents in some homes between $570 and $845 per year.

The mayors would like to see school property taxes for Metro Vancouver based on how much is spent in the region on education instead of on property assessments, citing a report by the Cascadia Partners that found Metro taxpayers paid three times more in school property taxes than the provincial average and received 12% less in education spending than it paid into provincial coffers.

“We think that the rate that they charge for school tax should be based on the region, not based on the provincial average,” Moore said, pointing out that if funding kept pace with money collected here, schools on Burke Mountain could be built by now.

Finally, mayors argue that some of the property transfer tax windfall paid for by local buyers should come back to Metro Vancouver in the form of help for affordable housing and transit.

“It’s as much as the provincial surplus and we didn’t get close to $1.5 billion into transportation and affordable housing,” he said, citing them as two of the region’s biggest issues going into the election.

As to whether the provincial parties — which have already crafted their campaigns — will weigh in on the question is uncertain.

Notes UBC’s Davidoff: “The challenge is how to do you settle economic issues in a campaign that’s going to be dominated by 30-second election issues?”

The provincial election will be held May 9.