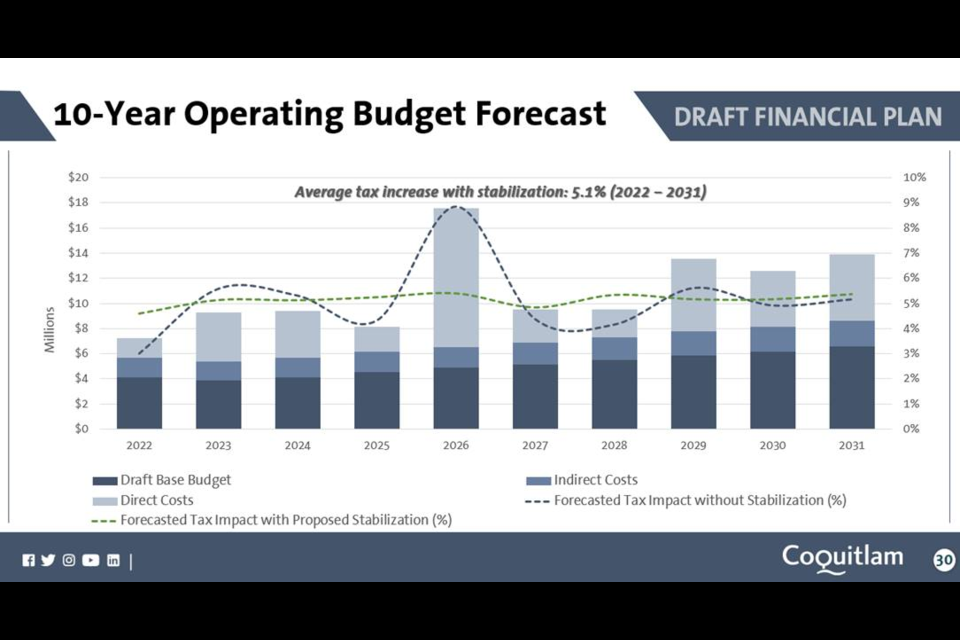

Coquitlam property owners could see their tax bills spike about five per cent each year for the next decade.

And that’s only if council OK’s a tax stabilization fund in its next round of budget approvals in December.

Last week, during presentations from department heads before council crunches the numbers, city staff warned of the heavy capital and operating costs coming down the pike.

For 2022, council is contemplating a 4.60 per cent uptick — nearly double from this year’s hike — that would translate to $156 more in property taxes and utilities for a single-family home or $146 more for apartment and townhouse owners.

The bill doesn’t include taxes for other agencies like the province (school) and TransLink (transit).

“It’ll be the first year of longer-term high tax increases,” advised Gorana Cabral, Coquitlam’s financial planning manager, while recommending that $2.5 million of tax growth revenues from 2021 be used to create a tax stabilization reserve, designed to “smooth out” volatility in future years and to avoid a nearly nine per cent jump in 2026.

As well, city managers are flagging some emerging trends that will have big implications for the way the City of Coquitlam provides programs and services to its ever-growing population.

Among them is an issue facing all Metro Vancouver municipalities in the next five years: a labour shortage.

With many municipal staff burned out from responding to the COVID-19 pandemic over the past 20 months — combined with one in four civic employees being eligible to retire by 2026 — city halls are “faced with the reality of a changing demographic that impacts our recruitment and retention,” said Nikki Caulfield, general manager of corporate services, noting the attrition of and competition for workers.

The pandemic was a major theme in the two days of budget talks, an annual tradition in which general managers tout their successes and offer their wish lists for the following year.

City manager Peter Steblin said the municipality will be operating at pre-pandemic levels moving forward in order to keep pace with demands and not to fall behind with staffing levels.

Indeed, nearly every department is requesting more help to keep tabs on the moving parts — from housing affordability and water rates to technology transitions and emergency operations.

City council is now analyzing their asks — as well as the cultural groups’ requests — before first reading of the $479 million financial plan on Dec. 6; the draft budget is $75 million higher than this year’s.

“These are not easy decisions,” Coun. Craig Hodge said. “They never are because, every year, we go into this with the idea that we are here to represent the residents of Coquitlam, the ratepayers, and we want to ensure that we continue to provide the best value that we can for the hard-earned tax dollars that the residents provide us.”

Here’s a breakdown of what departments are asking for in 2022:

CITY MANAGER

Peter Steblin is asking council for a $249,000 bump — or a 0.15 per cent tax lift — to pay for an intergovernmental relations manager ($138,100) and a privacy analyst ($110,900) to handle external agency and First Nations matters, as well as freedom of information (FOI) requests.

Despite recently losing the court case against FortisBC to remove its pipeline from under Como Lake Avenue, the city has made strides to represent the interests of Coquitlam residents, Steblin said, noting other pressures from Trans Mountain, the Port of Vancouver and Metro Vancouver.

And, on the FOI front, the city is handling more requests for information for insurance claims such as access to traffic camera footage and fire incident reports, said Jay Gilbert, Coquitlam’s director of intergovernmental relations and legislative services.

Besides the pandemic recovery, the top items that Steblin will be overseeing in 2022 are the Spani Pool renewal, the Integrated Development Financial Review, the Climate Action Plan and regional policing initiatives, as well as a focus on diversity, equity and inclusion.

DEPUTY CITY MANAGER

Raul Allueva, whose portfolio now includes economic development and planning/development, is asking for $338,100 — to be self-funded, with a zero tax impact — to pay for an in-house lawyer ($159,700) to handle the transit-oriented development and other planning applications, as well as transitional funding ($178,000).

Allueva is also requesting $120,000 for an economic development strategy — to come through the Economic Development Reserve — to study job generation and future trends.

He applauded city staff for pivoting during the pandemic. “There have been a lot of things coming at us,” he told council, adding the health emergency “is changing the way we work.”

Still, Coun. Chris Wilson urged Allueva, who also manages bylaw enforcement, to stay on top of taxpayers’ concerns especially for construction along the Evergreen Extension corridor. “It’s taken a huge toll on our residents,” Wilson said, noting the negative impacts with building hours, road closures and garbage/recycling collection.

PLANNING AND DEVELOPMENT

Newly appointed GM Don Luymes, who previously held the parks/rec portfolio, took over from Jim McIntyre this year — in the middle of a massive building boom.

Coquitlam is “already 50% ahead of last year,” he said, noting the city issued 549 building permits from January to September in 2021, equalling a construction value of $269 million. As well, during that same time period, the city inspected a combined 17,443 building and plumbing jobs.

Currently, Coquitlam has 208 active development applications, along with four master development plans on the books that, if approved, would bring in 42 towers with about 20,500 homes; it also has 12 transit-oriented bids in-stream that call for 13 towers with 4,100 units.

Luymes is asking for nine new positions in his department, of which one planner is proposed to be funded from general taxation ($101,200 or a 0.06 per cent tax lift); seven jobs are to be self-funded (through development); and a one-year systems analyst position to be paid from reserves, for a total value of $805,500.

Luymes also wants to raise building permit and development services fees to adjust to a 2.8 per cent inflation rate; if approved, those new revenues would yield $191,700.

Coun. Dennis Marsden pressed Luymes to find ways to speed up the planning process, commenting on a recent development application that took nine months to get to third reading.

ENGINEERING AND PUBLIC WORKS

With planning comes engineering to lay the ground work.

GM Jaime Boan is asking for $282,200 — or a 0.11 per cent tax hike — to pay for three positions, as well as $613,100 for five positions with no tax impact.

Boan warned council about the rising costs of materials and tradespeople, as well as the aging infrastructure (sewer/drainage systems).

As for the rising cost of water that’s supplied by Metro Vancouver, Boan said taxpayers will be hit hard in the next few years.

Boan highlighted four capital projects that the city will work on in 2022: the transit-development monitoring program; eMobility; safety mobility; and Quarry Road (from Gilley’s Trail to Widgeon Park), of which a portion will be paid by Metro Vancouver.

PARKS, REC, CULTURE AND FACILITIES

Newly appointed GM Lanny Englund has 11 requests for council to consider — mostly for labour. Five of them represent a 0.19 per cent tax hike.

Like Luymes, he’s also asking for a fee increase of 2.8 per cent to reflect inflation, which would yield $34,900 from rec users.

With three rec centres coming online by 2026 — the Burquitlam YMCA, Place Maillardville and the $115 million Northeast Community Centre, the latter of which got council’s blessing last month — as well as the southern extension of the Coquitlam Crunch, the Spani Pool renewal and the next phases for Mackin and Glen parks, Englund’s plate is full.

And he cautioned that the city will likely have to dip into its own reserves from development to borrow for the big capital projects.

Still, council voiced its concern about the lack of pickleball facilities in the city (an update on the tennis/pickleball strategy is due early next year).

With the high price for real estate, the municipality needs to secure space for the sport, Coun. Chris Wilson said. “If we don’t start identifying areas where pickleball could be played… eventually that land will be used for other things,” he said. “The demand is much higher than we can accommodate right now.”

RCMP

Coquitlam detachment’s Supt. Keith Bramhill isn’t asking for additional Mounties next year given the new union contract that uniformed officers inked this summer.

The ratification of the first-ever RCMP collective agreement is a big driver for the 2022 budget increase, as the deal will require retroactive pay and wage improvements.

Gorana Cabral, Coquitlam’s manager of financial planning, said the RCMP contractual settlement will add another $1.34 million to the operating budget — about a one per cent spike. Civilian staff are also due to receive a two per cent uptick to their CUPE pay.

Currently, the detachment has 244 RCMP officers, of which 166 are seconded to Coquitlam, 75 to Port Coquitlam and three to provincial units.

On its 2022 agenda, Bramhill said, is the need to implement a mental health mobile unit with Fraser Health — taking pressure off RCMP duties — as well as regional policing initiatives and a strategic plan renewal.

FIRE/RESCUE

Fire chief Jim Ogloff is asking for $24,600 — to be funded internally, with no tax impact — for a temporary part-time support clerk to help process additional inspection assignments.

But, for the five-year capital plan, he’s requesting $800,000 to replace the self-contained breathing apparatus (SCBA) and $500,000 for a fire/rescue support vehicle.

With a crew of 183 FTE, Ogloff said the department is facing pressures with the population growth. In December, he plans to talk to council about the Southwest Fire Protection Strategy.

CORPORATE SERVICES

GM Nikki Caulfield, who oversees IT, human resources and communications, is calling for five new positions for a total of $692,500 or a 0.37 per cent tax lift.

They are a manager of diversity, equity and inclusion ($184,800); a civic engagement manager ($140,000), following a recent review of the communications division; a business services manager ($157,100); an IT systems specialist ($123,700); and an engagement data analyst ($86,900).

As well, she’s requesting that $200,000 be spent on civic space planning at city hall and the annex.

FINANCE AND LANDS

GM Michelle Hunt is asking for three positions for a total tax impact of 0.10%: a business services manager (to be equally shared with corporate services); a utilities accounting clerk; and a senior real estate specialist.

As well, Hunt is requesting $1 million to pay for the growing number of successful tax appeals, to come from reserves (there are about 160 outstanding appeals).

•••••••••••••••

PAST TAX HIKES

- 2021: 2.69%

- 2020: 2.64%

- 2019: 2.56%

- 2018: 2.06%

- 2017: 2.13%