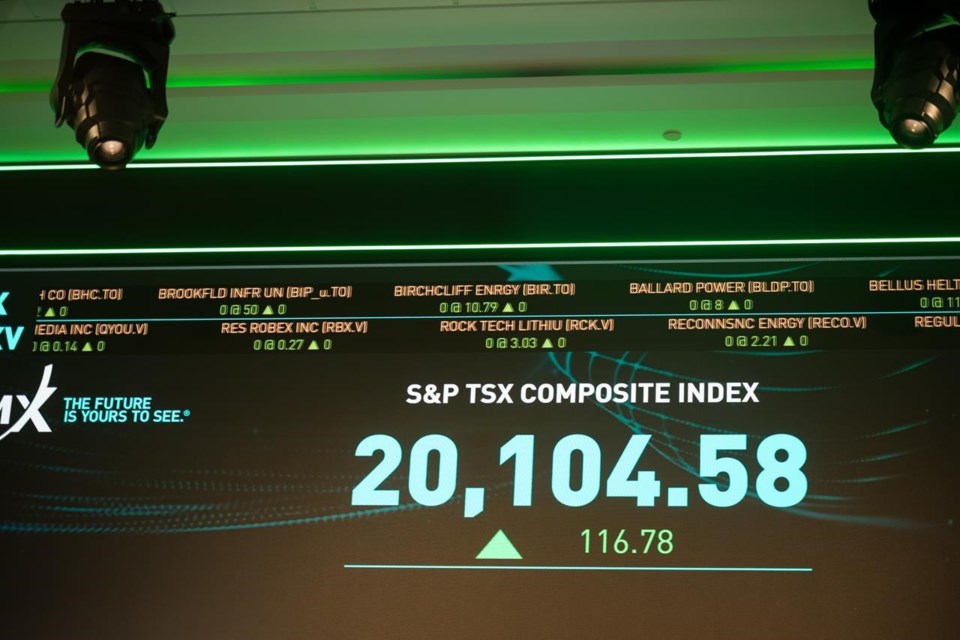

TORONTO — Canada's main stock index gained more than 100 points Friday, led by strength in energy, technology and base metals, while U.S. markets also rose, as investors on both sides of the border reacted to the latest labour market data.

The S&P/TSX composite index closed up 108.26 points at 19,246.07.

In New York, the Dow Jones industrial average was up 288.01 points at 33,407.58. The S&P 500 index was up 50.31 points at 4,308.50, while the Nasdaq composite was up 211.51 points at 13,431.34.

Markets on both sides of the border dipped to start the day before rising.

“It’s a pretty meaningful reversal from the knee-jerk reaction that we saw in the morning,” said Angelo Kourkafas, an investment strategist at Edward Jones.

That knee-jerk reaction was to the latest jobs data, which came in hotter than expected for both countries. The Canadian economy added 64,000 jobs, more than three times economist expectations, and its unemployment rate held steady at 5.5 per cent. The U.S. added 336,000 jobs, almost twice what was expected.

That data is part of the suite of economic indicators that central banks are eyeing for their upcoming interest rate decisions, and continued economic strength could spell another rate hike.

Despite the initial reaction, markets ended the day on a decidedly sunnier note. That’s because beyond the headlines, investors saw encouraging signs that the labour market is moderating, said Kourkafas.

Wage growth in the U.S. moderated in September, with average hourly earnings rising at their slowest year-over-year rate since June 2021. Meanwhile, even though Canadian wage growth year-over-year was slightly higher in September than in August, most of the job gains were concentrated in the educational services sector, noted Kourkafas, and most were in part-time employment.

“These details should throw some cold water on a seemingly hot jobs report,” wrote TD director of economics James Orlando in a client note.

The recent pullback in oil prices is also helping calm inflation worries, noted Kourkafas.

Next week, the U.S. Federal Reserve will get another big data point to help with its impending decision, as the latest inflation data comes out Thursday.

At the end of the week, earnings season south of the border kicks off with the banks.

The Canadian dollar traded for 73.08 cents US compared with 72.82 cents US on Thursday.

The November crude oil contract was up 48 cents at US$82.79 per barrel and the November natural gas contract was up 17 cents at US$3.34 per mmBTU.

The December gold contract was up US$13.40 at US$1,845.20 an ounceand the December copper contract was up eight cents at US$3.63 a pound.

-- With files from The Associated Press

This report by The Canadian Press was first published Oct. 6, 2023.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

Rosa Saba, The Canadian Press