There are serious problems with B.C. Finance Minister Mike de Jong's efforts to disprove the foreign ownership myth last week — after just three weeks of studying the problem after changes to the property transfer tax form

Here are some takeaways from a series of reports, which appeared to be more about getting out the BC Liberal government message than dealing with a growing affordability problem.

First, the reports suggest property flipping isn't a problem and speculation is no worse than in previous hot real estate cycles.

But the information provided on property flipping was for all of B.C., not just markets where the activity is expected to be most heated. As well, property speculation may already be on the wane because of the challenges in flipping an already over-priced property, and thus not a really useful data set.

Second, the report suggested red tape at city hall is to blame for the tight housing market because projects can take up to 13 years for approval.

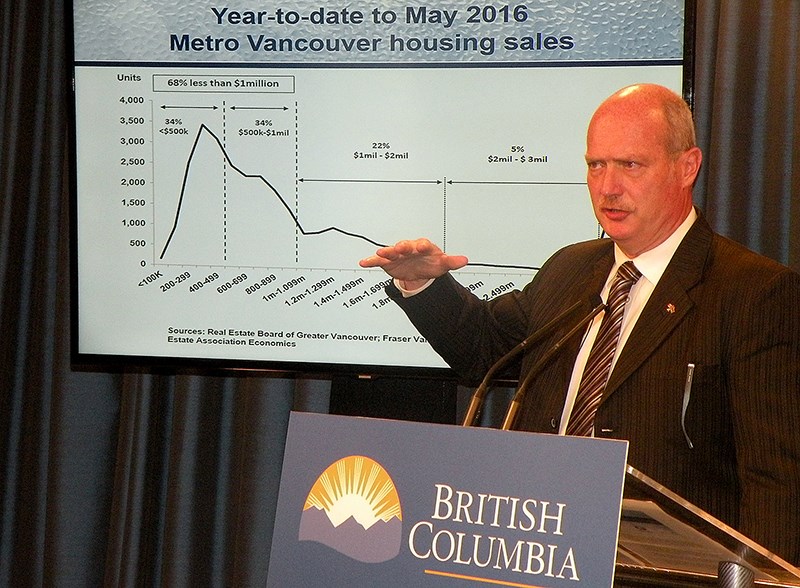

This is a red herring because many people who grew up in the region want a detached home, not necessarily a new condo, and at $1.2 million -- the Coquitlam benchmark price -- a house with a yard is out of reach for all but those whose parents can cash out and move in with them.

Third, the report stated that foreign buyers only make up a small part of the market, or 5.1% in Metro Vancouver.

Sadly, nobody believes this because place of residence is self-reported and the purchaser can use a company or law office with a local address.

Fourth, the report notes that 3,603 families have saved an average of $7,060 on their newly purchased homes and 10,470 didn't have to pay property transfer tax because they were first-time buyers.

Unfortunately, these amounts are chump change when compared to the size of a downpayment and a mortgage on the $774,000 benchmark price of a residential/composite home in Coquitlam.

The bottom line is people who were supposed to be in charge were asleep at the switch and Metro Vancouver families are paying a hefty price as a result — a price fewer and fewer can afford.