The increasing cost of living and skyrocketing property values has more people over 55 taking advantage of the provincial property tax deferral program, according to a new report.

B.C. seniors advocate Isobel Mackenzie said the popularity of the program, which was launched in 1974, has outpaced growth in the seniors population, increasing 53% in the last few years. She added that across the province 57,305 seniors deferred a total of $208 million in property tax in 2018.

"The value of houses has increased significantly," she said. "When you look at deferring your taxes, it now seems like a pretty small debt compared to the value of your house."

Seniors on a fixed income may be looking at different ways of reducing budget pressures, Mackenzie said. She noted that property taxes and utilities have been rising at a faster clip than most people's retirement incomes, which typically follows the rate of inflation.

"This is one of the ways of addressing those costs," she said. "So people may be educating themselves."

There were close to 14,000 new users of the property tax deferment program in B.C. in 2018, a jump of 27% over the previous year and a 155% rise since 2014.

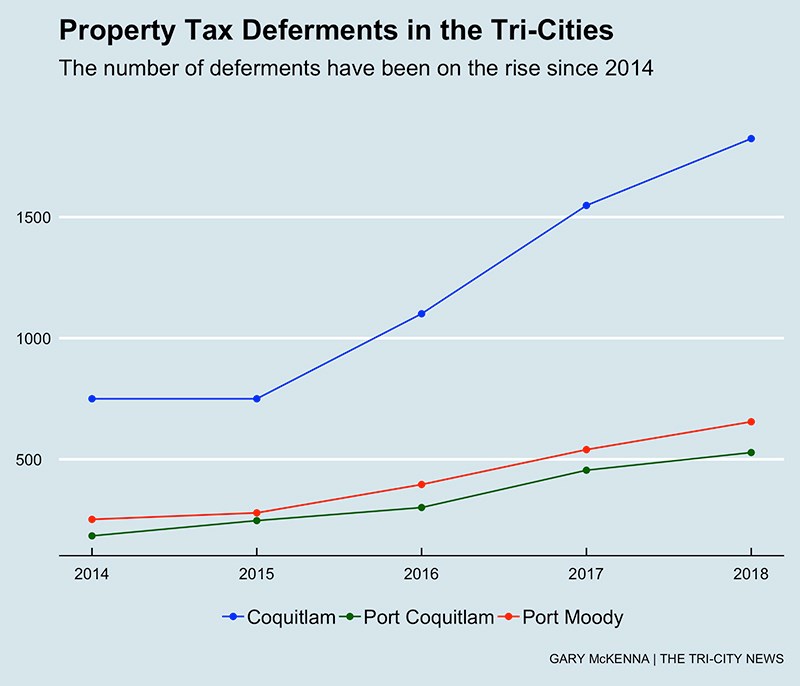

The numbers for municipalities in the Tri-Cities are headed in similar direction.

In Coquitlam, more than $7.3 million in taxes were deferred by 1,824 property owners, a rise of 133% over the last five years. Port Coquitlam and Port Moody have seen even larger percentage gains.

In PoCo, 528 people took advantage of the program in 2018, a jump of 187% since 2014, totaling close to $1.6 million, while Port Moody's numbers during the same time period jumped 160% to 655 for a total of $2.6 million in deferred taxes.

"People defer their taxes for a number of reasons and we could see an increase in deferments due to baby boomers retiring, particularly for those who want to remain in their homes but who are on fixed incomes," said Shelly Ryan, Coquitlam's revenue services manager.

Because the program is administered by the province the increase in users does not impact municipal budgets. Essentially, participants are given a low-interest loan — the interest rate is currently 1.45% but has been as low as 0.7% — that can be paid back when the home is sold.

"We anticipate the number of deferments to continue to increase due to the low interest rate and increasing numbers of taxpayers who qualify for the program," said Brian North, Port Coquitlam's manager of revenue and collections.

@gmckennaTC